God’s Time!

Hello Dealmakers,

If you’re like me, the following applies to you:

✅ You or someone you know is interested in buying, exiting, or expanding their business, in the short run

✅ You identify as a connector and love to help people to achieve their goals

✅ You have learned a lot from work/life experience, trainings, and personal research

When a business owner is looking to retire it’s easy to think “I’m ready to move on. I’ll just list my business and Sell my business in the next few months.”

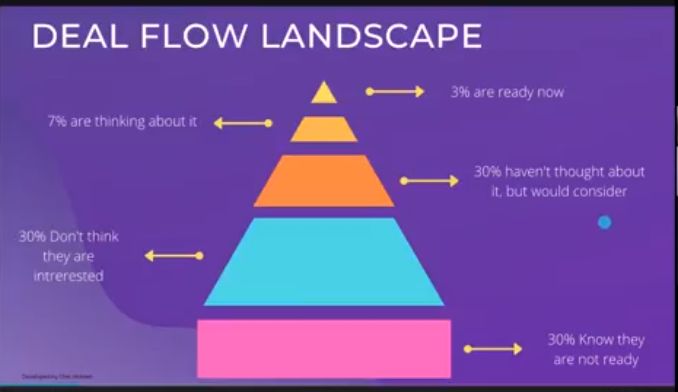

According to OutFlow research statistics:

💵 3% are ready now

💵 7% are thinking about it

💵 From the 7% group: their typical exit timeframe is 3–7-years

The problem is that they need help closing the gaps between where their business is now and where it needs to be for an optimal exit valuation.

@Jeramiah Townsend says:

Buying or selling a business is easy in theory but hard in practice.

If you are looking at selling your business you should do the following:

1) get an advisor to have an initial conversation with. Chances are you don’t sell companies every day, and an initial conversation with a professional will give you great info and an idea if it’s worth it to go it Alone and risk failure (over 80% of companies don’t sell on their own)

2) set a realistic selling price that an investor can afford to pay. You might want so much… but think if it from the buyers perspective.

3) start shining your business up. Just like cleaning and polishing a car before you sell it so you can get the best price, your business, which is worth far more, is worth even more attention. And yes you likely should hire a professional to give you at least some initial advice and a third party perspective.

4) start grooming a replacement. On average it takes over 9 months to sell a company. And to make the highest value it can take 1-2 years of preparation! So make sure you have a replacement manager or CEO that you are grooming now. They might even become your buyer.

5) think about what you will do after you sell and what you will do with the money. If you just plan to keep most of the cash in a bank account (like most sellers) then you might consider either holding onto your business real estate to take advantage of passive appreciation and rental income, or even offering an owner carry note for part of the business sale (maximizing your sale price).

There is no time like the present!

Reach out to me if you have questions. I’m an investor and business advisor. I do this every day. And I love talking shop.